Unit 1:

Introduction to Accountancy

Accounting.

Accounting is the art of recording, classifying, and summarising In a significant manner and in terms of money and transactions and events.

Help the decision makers of a Company to make effective choices by providing information on financial status of the business.

Objectives of Accounting.

- To keep systematic record of business transactions according to specified rules.

- To calculate profit or loss during a particular period

- To ascertain the financial position of the business. Profit and loss not sufficient Businessmen must know financial health of the business. So after profit and loss account balance sheet is prepared.

- To provide information to various parties like investors, creditors, banks, employees and government authoritie’s.

- To prevent an detect errors and frauds as it follows various accounting principles and guidance.

Functions of accounting.

- Maintaining complete and systematic records.

- Preparing of financial statements.

- Communicating the financial results to various parties.

- Providing assistance to management.

- Fixing responsibility.

- Compliance of legal needs.

- Preventing errors and frauds.

- Preparing budgets.

Users of accounting information.

Internal users.

- Owners.

They contribute capital in the business and once to know about profitability, financial soundness, and profit increasing or decreasing.

- Management.

Need information for the efficient and smooth running of business. Get information from Profit and Loss account, balance sheet and Cash flow account. They get most of the information from unpublished internal reports.

- Employees.

They need information about profits so that they can ask for higher wages and bonus.

External users.

- Potential investors

So that they can judge how safe and rewarding the proposed investment will be.

- Short term creditors.

Information about Credit worthiness of business enterprise.

- Long term creditors.

One to judge whether their principal and interest will be repaid when do an whether they should extend, maintain or restrict the long term loans to the enterprise.

- Tax authorities.

Information of assessment of income tax.

- Government and their agencies.

Need information to form policies relating to taxation, allocation of resources and for providing subsidies.

- Competitors.

Want information on relative strength and businesses of enterprise for making comparisons.

- Public.

Enterprise affects the public in variety of ways. They provide employment, amenities in locality and bring customers to local suppliers.

Advantages of accounting.

- Helpful in planning.

- Helpful in decision making.

- Helpful in controlling.

- Provides complete and systematic record.

- Provides information regarding profit and loss.

- Provide information regarding financial position.

- Helpful in prevention and detection of errors and frauds.

- Helpful in raising loans.

Accounting cycles.

It is a multi step process used by businesses to create an accurate record of their financial position as summarised on their financial statements.

Its main purpose is to keep track of all financial activities that occurred during Specific accounting.

- Identification of business transactions.

Only those transaction Which can be measured and express in monetary terms are recorded in the books of account.

It must be everywhere by an appropriate document prepared by appropriate authority.

- Preparing of accounting vouchers.

In accounting, business transactions are identified and head of account is selected on the basis of source document.

Recording in books of account are made with the help of accounting vouchers.

- Recording in the books of original entry.

On the basis of accounting vouchers, transactions are recorded in the first instance in the books of original entry.

Journal is one of the original books of entry.

- Posting into Ledger.

It involves transferring the transaction recorded in the journal or subsidiary books in their respective accounts in the Ledger.

- Balancing of Ledger account.

It involves ascertainment of net effect of transaction on an account head.

At periodical intervals balances of each accounts in the Ledger is ascertained.

- Preparation of trial balance.

A list showing balances of each account is prepared to check the arithmetical accuracy of the Ledger.

7. Preparation of Income Statement.

In this trading and Profit & loss account by non corporate entire entities is prepared to ascertain the profit and or loss suffered by the business during a particular accounting period.

8. Preparation of position statement.

Position statement, that is balance sheet is prepared to ascertain the financial position of the businesses at the end of each accounting period.

Accounting principles.

Those rules of conduct or procedure which are adopted by the Accountants Universally for recording or reporting of financial data.

- Accounting principles are uniform set of rules or guidelines developed to ensure uniformity and easy understanding of the accounting Information.

- Accounting principles are man made and are derived from experience and region. Not laboratory tested, hence lack of universal applicability like principle of physics, chemistry and other natural sciences.

- Accounting principles are not static and are bound to change with the passes of time.

- Need of accounting principle.

In order to make the accounting information meaningful to its internal an external users, it is significant that such information is reliable as well as comparable.

The comparability of information is required to see how a firm has performed as compared to other firms and how it has performed as compared to previous years.

This becomes possible only if the information provided by the financial statement is based on some set of rules known as policies, principles and conventions.

These rules known as Generally Accepted Accounting Principle GAAP.

Which brings uniformity and consistency to the process of accounting.

Classification of accounting Principles.

- Accounting concept.

- Business entity concept.

- Going concern concept.

- Money measurement concept.

- Accounting period Concept

- Cost concept.

- Dual aspect concept.

- Revenue recognition concept.

- Matching concept.

- Consistency concept.

Accounting standards.

Accounting Standards are the policy document issued by the recognised expert accountancy body relating to various aspects of measurement, treatment and disclosure of accounting transactions And events.

As per Communist Act. 2013. Section 2, two Accounting Standard means the standard of accounting or any addendum. Tier 2 for companies or class of companies referred to in section 33.

It should be noted that accounting standards may be national or international or both.

Every national accounting body frames its accounting standard in keeping with the law in force, in conformity with the international norms or global standards.

Need and importance of accounting standards.

1.Harmonisation of diverse accounting policies and practises.

Accounting standard must be developed for the development of accounting as a business language.

The central idea of accounting standards is to harmonise the diverse accounting policies and practises, followed by the business enterprise.

2. Reinforcement of investor confidence.

The limitation of condentional GAAP have complained to standardise the treatment of accounting events and disclosure of the same in the financial statements.

So to reinforce investors, confidence on the audited accounts, standardisation of the treatment of accounting events and disclosure of the scene in the financial statement are needed.

3.Transparency

Accounting standards help companies report financial information in a clear and transparent way.

4. Decision making

Accounting standards help investors and companies make decisions by making reporting uniform and understandable.

5. Financial fraud

Accounting standards help prevent financial fraud and manipulation by providing clear guidelines.

6. Management performance

Accounting standards can help measure management’s ability to increase profitability and maintain solvency.

7. Common accounting language

Accounting standards establish a common accounting language across the globe.

International Financial Reporting Standards. IFRS

Issued by International Accounting Standard Book. I A S B

IFRS also cover a wide range of International Accounting standards issued by the International Accounting Standard Committee IASC.

Benefits of International Financial Reporting Standard.

- Helpful to enterprises operating globally.

International Financial Reporting Standard Unified the accounting practises worldwide, as a result of which the problem of consolidation is avoided.

2. Helpful to industry.

Obtaining funds from outside the country becomes easier if the financial statements comply with globally accepted accounting standards.

- Helpful to accounting professionals.

Able to provide better service in country adopting International Financial Reporting Standards.

- Helpful to investors.

Investors require high quality, relevant, derivle transferring and comparable information in financial statements in order to make economic decisions.

So International Financial Reporting Standards could be helpful to investors in comparison to financial statements prepared under different accounting standards adopted by different countries.

Unit 2:

Accounting Process

Process of Accounting

What is Bookkeeping?

Bookkeeping is the art of recording transactions in terms of money or money’s worth Systematically in a set of books. So that the financial position of a undertaken and is relationship to both its proprietors or outsiders can be readily asserted at any time.

Process of bookkeeping.

1. Identifying steps an measuring transactions in a common monitoring units.

2. Identifying the accounts effecting why transaction.

3. Recording the identify transaction in journal or subsidiary books initially.

4. Classify and posting that and actions into the Ledger.

5. Balancing the Ledger account.

6. Preparing a trial balance to check the arithmetical accuracy of the recorded transaction.

Objectives of Bookkeeping

- Recording transactions

- To keep a complete and accurate record of all financial transactions in a systematic, logical, and orderly manner.

- Showing the correct position

- Detecting errors and frauds

- Helping in decision making

- Giving information to prepare financial statements

- Aiding in tax planning

- Aiding in budgeting, forecasting, and financial planning

Limitations of Accounting

- Historical nature

Accounting is historical, so it doesn’t reflect the current financial position of a business. - Inflation

Accounting statements may not always provide comparable data because principles are not static. For example, if inflation is relatively high, the amounts of assets and liabilities in the balance sheet will appear inordinately low. - Measurability

Accounting can’t measure the value of non-monetary terms, things, or events. - Errors and frauds

Accounting is done by humans, so there will always be the scope of human errors. There is also the fear of possible manipulation of accounts to cover up a fraud.

Double entry system

Double-entry accounting is a method of recording financial transactions in two accounts, balancing the accounting equation: Assets = Liabilities + Equity. The purpose is to tally both the accounts and balance the credit and the debit side.

Advantages of double entry system.

- Accuracy

Each transaction is recorded twice, once as a debit and once as a credit in two different accounts. The total amount of the debit entries must equal the total amount of the credit entries for a transaction to be considered balanced. - Ease of verification

The double-entry system makes it easier to identify errors, omissions, and fraud. - Protection from fraud

The chances of fraud are comparatively less than in any other accounting system. - Complete information

The double-entry accounting method gives you more complete information about a transaction when compared to the single-entry method, as each transaction consists of both a destination and a source. - Accountability

The double-entry system is a scientific and systematic system of recording transactions.

Disadvantages of double entry system?

- Complexity: The double-entry system is a formalized accounting system that requires specialized training to use correctly.

- Cost: The complexity of the double-entry system means that it can be more expensive.

- Time: The double-entry system is a time-consuming process.

- Expert knowledge required: Recording transactions using the double entry system requires knowledge of accounting.

- Not for small businesses: Small businesses find it difficult to implement this bookkeeping system.

- No accuracy before making of trial balance: Finding mistakes can take longer time.

- Maintenance costs high: Maintaining accounting books takes time due to double entry.

Kinds of Accounts

- Personal Account

- Real Account

- Tangible Real Account

- Intangible Real Account

- Nominal Account

Personal Account

These accounts types are related to persons. These persons may be natural persons like Raj’s account, Rajesh’s account, Ramesh’s account, Suresh’s account, etc.

These persons can also be artificial persons like partnership firms, companies, bodies corporate an association of persons, etc.

For example – Rajesh and Suresh trading Co., Charitable trusts, XYZ Bank Ltd, C company Ltd, etc.

There can be personal representative accounts as well.

For example – In the case of Salary, when it is payable to employees, it is known how much amount is payable to each of the employee. But collectively it is called as ‘Salary payable A/c’.

Rule for this Account

Debit the receiver.

Credit the Giver.

For Example – Goods sold to Suresh. In this transaction, Suresh is a personal account as being a natural person. His account will be debited in the entry as the receiver.

Real Accounts

These account types are related to assets or properties. They are further classified as Tangible real account and Intangible real accounts.

Tangible Real Accounts

These include assets that have a physical existence and can be touched. For example – Building A/c, cash A/c, stationery A/c, inventory A/c, etc.

Intangible Real Accounts

These assets do not have any physical existence and cannot be touched. However, these can be measured in terms of money and have value. For Example – Goodwill, Patent, Copyright, Trademark, etc.

Real Account Rules

Debit what comes into the business.

Credit what goes out of business.

For Example – Furniture purchased by an entity in cash. Debit furniture A/c and credit cash A/c.

Nominal Account

These accounts types are related to income or gains and expenses or losses. For example: – Rent A/c, commission received A/c, salary A/c, wages A/c, conveyance A/c, etc.

Rules

Debit all the expenses and losses of the business.

Credit the incomes and gains of business.

For Example – Salary paid to employees of the entity. Salary A/c will be debited when the expenses are incurred. Whereas, when an entity receives any interest, discount, etc these are credited whenever these are received by the entity.

Rules-Transaction Analysis

Journal

journal is a record of financial transactions where transactions of a business are ordered by date.

A journal is defined as the book of original entry.

Advantages

- Journal records all the financial transactions of a business in one place on a time and date basis.

- There is less chance to avoid transactions as in a journal we record every transaction on a date basis.

- The accountant writes each journal entry’s narration below every journal entry so that another auditor can audit it without any confusion.

- Journal posts the transactions in their respective ledger accounts. Without making this journal, an accountant will be unable to make the ledger accounts.

- In case of a mistake in the ledger accounts, this can be easily rectified with the help of a journal or by passing a rectified journal entry in the journal.

Features of journal

A journal is a subsidiary book of account that records monetary transactions according to accounting standards. Some features of a journal include:

- Chronological order: Contains day-to-day transactions in chronological order

- Details: Shows complete details of a transaction in one entry

- Debits and credits: Records both the debit and credit aspect of a transaction according to the double entry system of book-keeping

- Journal entry: A properly formatted journal entry will include the correct date, the general ledger accounts, the amount(s) to be debited, the amount(s) to be credited, a description of the transaction, and a unique reference number, such as a check number

- Trial balance: At the end of an accounting period, after all the journal entries have been made, accounting professionals create what’s called a trial balance

- Footer: A footer line with a brief description of the reason for the entry

Functions of journal

- Recording: A journal records all financial transactions of a business in one place on a time and date basis.

- Analytical: Each transaction is analyzed into the debit aspect and the credit aspect.

- Reconciling: The information recorded in a journal is used to reconcile accounts.

- Transferring: Journals can be used as a tool for transferring information to other accounting records, such as general ledgers.

- Chronological order: All transactions in a journal are recorded in chronological order, that is, exactly when they occur.

Ledger

Ledger accounts are a record of business transactions. They are a separate record within the general ledger that is assigned to a specific asset, liability, equity item, revenue type, or expense type.

Ledger accounts are significant.

- Help businesses keep track of their finances

- Helps prepare a trial balance

- Provide insight into how much profit or loss is being made within a certain time period

- Help with bank reconciliation

- Document the financial activities of a business in a systematic and organized manner

The main objectives of a ledger are:

- Record business transactions: Ledgers record financial transactions in a systematic and permanent way.

- Classify accounts: Ledgers classify accounts as assets, liabilities, income, expenses, and capital.

- Find account balances: Ledgers help find the balance in each account.

- Provide information: Ledgers provide detailed information on any account for a given period.

- Prepare trial balance: Ledgers assist in the preparation of trial balance.

- Provide a comprehensive report: Ledgers provide a comprehensive report of all transactions.

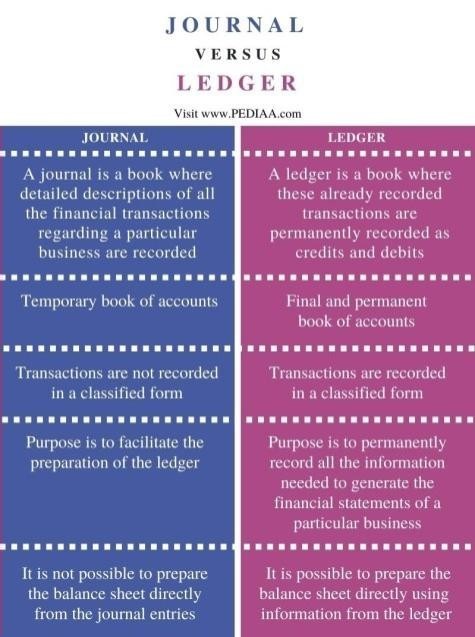

Difference Journal and Ledger

| Journal | Ledger |

| A journal is a book where detailed descriptions of all the financial transactions regarding a particular business are recorded | A ledger is a book where these already recorded transactions are perrnanently recorded as credits and debits |

| Temporary book of accounts | Final and permanent book of accounts |

What is posting?

In accounting, posting is the process of moving a transaction entry from a journal to a general ledger. The purpose of this is to group all transactions related to a certain account in one place.

A journal’s entries are chronological while a ledger compiles its transactions by accounts, such as assets or liabilities.

Posting is carried out by:

- Recording a transaction in the journal, which is called journalizing

- Transferring the information recorded in the journal entries to the general ledger

For example, ABC’s controller creates a posting entry to move the total of these sales into the general ledger with a $300,000 debit to the accounts receivable account and a $300,000 credit to the revenue account.

Balancing of accounts

Balancing of an account is the process of calculating the difference between the debit and credit sides of an account. The difference is then placed on the side with the lesser total so that the totals of both sides are equal. The words “balance carried down (c/d)” are written against the amount of the difference.

For example, if the debit amount exceeds the credit amount, the remaining “h / b” is next to the credit.

An example of a balanced account is a credit card with purchases that total $175 and a returned item that costs $10. The net of the debits and credits is $165, which is the account balance.

Trial Balance

A trial balance is a financial report that lists all ledgers and their balances. It’s used to confirm that the sum of all debits equals the sum of all credits.

Advantages of a trial balance include:

- Confirms accuracy

A trial balance confirms that posting and other accounting processes have been carried out without committing arithmetical errors. - Helps prepare final accounts

A trial balance acts as a summary for each account. - Finds errors

A trial balance finds errors during bookkeeping. For example, if an account has a credit balance but a debit amount, the whole ledger will be checked. - Helps in audit

A trial balance is used by auditors to find errors in books or to see if there are any unusual transactions

A trial balance has some limitations, including:

- Errors

A trial balance doesn’t find all kinds of errors, even if the columns agree.

- Missing entries

A trial balance can’t find missing entries from the journal or ledger - Accuracy

A fully balanced trial balance doesn’t assure that there is 100% accuracy in all the accounts - Double-entry system

A trial balance can only be prepared if the accountant follows the double-entry system of accounting

Problems on journal

Ledger Posting and Preparation of Trial Balance

Rectification of Error

Bank Reconciliation Statement

A bank reconciliation statement (BRS) is a financial document that compares a company’s bank account balance with its own accounting records. The purpose of the statement is to identify and reconcile any differences between the two balances. This statement helps ensure accuracy and consistency in financial records.

The statement includes all transactions, such as deposits and withdrawals, from a given timeframe. It also displays the reasons for the differences between the two balances.

Features

- Reconciles differences.

A BRS reconciles the causes of difference between the bank balance as per cash book and the bank balance as per pass book. - Confirms payments.

BRSs confirm that payments have been processed and cash collections have been deposited into a bank account. - Checks entries

BRSs check entries on a monthly basis to avoid any future discrepancy. - Spots errors

BRSs help spot accounting errors, such as missed or double payments, early.

Other features of a BRS include:

- Deposits are shown in the credit column and withdrawals are shown in the debit column

- The aggregate amount of debits should be equal to the aggregate amount of credits

- Routine reconciliations can find and fix errors or discrepancies in financial records quickly

- This lessens the possibility of fraud or theft

- Assists in ensuring the correctness of financial accounts

Diff bank statement & bank Reconciliation Statement

| Basis | Bank Statement | Bank Reconciliation Statement |

| 1. Source of Information: | Provided by the bank, it lists all transactions related to an account, including deposits, withdrawals, and other activities. | Created internally by a company, it compares the bank statement with the company’s cash records. |

| 2. Purpose: | A summary of account activity for a specific period, helping account holders track transactions and monitor balances. | Used to identify and rectify discrepancies between the company’s cash records and the bank statement, ensuring accuracy in financial reporting. |

| 3. Preparation Party: | Prepared by the bank and sent to the account holder regularly, typically monthly. | Prepared by the company’s accounting department to reconcile its records with the bank statement. |

| 4. Nature of Information: | External document providing an overview of all financial transactions directly involving the bank account. | Internal document focused on comparing and adjusting discrepancies between the company’s records and the bank statement. |

| 5. Timing: | Reflects transactions as processed by the bank during a specific period. | Created after receiving the bank statement, ensuring that the company’s records match the bank’s data for the same period. |

Errors of omission are mistakes that result from not doing something. For example, forgetting to file a report would be an error of omission.

Errors of commission are mistakes that occur while performing a task.

For example, driving your car through a stop sign without stopping would be an error of commission.

Here are some examples of errors of omission and commission:

- Errors of omission

Forgetting to file a report, not shoveling so a pedestrian slipped and fell, not including shares in a portfolio that outperformed - Errors of commission

Incorrectly recording a transaction in account books, driving through a stop sign without stopping, broadcasting a financial amount in an incorrect account

Unit 3

- Difference Between Purchase account and Purchase book

“Purchase account” and “purchase book” are terms used in accounting to refer to different aspects of the purchase process. Let’s explore the differences between the two:

1. **Purchase Account:**

– **Nature:** The purchase account is a nominal or temporary account found in the general ledger.

– **Function:** It is used to record the total value of goods purchased during a specific accounting period.

– **Recording:** All purchases, whether made on credit or with cash, are initially recorded in the purchase account.

– **Location:** The purchase account is part of the financial statements, specifically the income statement, and reflects the cost of goods sold or cost of goods consumed during the period.

2. **Purchase Book:**

– **Nature:** The purchase book is a subsidiary or special purpose book used in the bookkeeping process.

– **Function:** It is designed to record detailed information about credit purchases of goods.

– **Recording:** Transactions recorded in the purchase book are typically on credit, involving purchases from suppliers on credit terms.

– **Format:** The purchase book typically includes columns for details such as date, name of the supplier, invoice number, particulars of the goods, and the amount.

– **Integration:** The total of the purchase book is periodically posted to the general ledger in the purchase account.

In summary, the key difference lies in their nature and function:

– The **purchase account** is an account in the general ledger used to summarize the total value of goods purchased during a specific accounting period. It is part of the financial statements, reflecting the cost of goods sold.

– The **purchase book** is a specialized journal used to record detailed information about credit purchases. It is a subsidiary book that provides a more detailed breakdown of individual transactions, which is later summarized in the purchase account.

Together, these elements form part of the overall accounting process, ensuring that a business accurately records and reports its purchases. The purchase book serves as a detailed record, while the purchase account provides a summary for reporting purposes.

- Difference between Sales Account and sales book

“Sales account” and “sales book” are terms used in accounting to represent different aspects of the sales process. Let’s clarify the differences between the two:

1. Sales Account:

Nature: The sales account is a nominal or temporary account found in the general ledger.

Function: It is used to record the total value of goods or services sold during a specific accounting period.

Recording: All sales, whether made on credit or with cash, are initially recorded in the sales account.

Location: The sales account is part of the financial statements, specifically the income statement. It reflects the revenue generated from the sale of goods or services during the period.

2. Sales Book:

Nature: The sales book is a subsidiary or special purpose book used in the bookkeeping process.

Function: It is designed to record detailed information about credit sales of goods or services.

Recording: Transactions recorded in the sales book are typically on credit, involving sales to customers on credit terms.

Format: The sales book typically includes columns for details such as date, name of the customer, invoice number, particulars of the goods or services, and the amount.

Integration: The total of the sales book is periodically posted to the general ledger in the sales account.

In summary, the key differences between the two are as follows:

The sales account is an account in the general ledger used to summarize the total value of goods or services sold during a specific accounting period. It is part of the financial statements, reflecting the revenue generated from sales.

– The sales book is a specialized journal used to record detailed information about credit sales. It is a subsidiary book that provides a more detailed breakdown of individual transactions, which is later summarized in the sales account.

Together, these elements contribute to the overall accounting process, ensuring that a business accurately records and reports its sales. The sales book serves as a detailed record, while the sales account provides a summary for reporting purposes.

- Cashbook

In accounting, a cash book is a financial journal that records all cash transactions of a business. It serves as a ledger account and is part of the double-entry bookkeeping system. The cash book is unique because it combines elements of both a journal and a ledger, making it a primary accounting book for cash transactions. There are different types of cash books, but the most common ones are the single-column cash book and the double-column cash book.

Here’s an overview of the two types:

1. Single-Column Cash Book:

Format: The single-column cash book has a single money column to record transactions involving only cash.

Entries: Transactions such as cash sales, cash purchases, and other cash-related transactions are recorded in this book.

Purpose: It provides a simple and straightforward way to record cash transactions and keep track of the cash balance.

2. Double-Column Cash Book:

Format: The double-column cash book has two money columns, one for cash and the other for discounts.

Entries: In addition to cash transactions, it records cash discounts given or received.

Purpose: It provides more detailed information about cash transactions and allows for the tracking of cash discounts, which is particularly useful for businesses that engage in discount practices.

Key Features of Cash Books:

Date: Each entry includes the date of the transaction.

Particulars or Details: Descriptions of the transaction, such as the reason for the cash inflow or outflow.

Amount: The amount involved in the transaction, recorded in the appropriate column (cash, discount).

Advantages of Cash Books:

1. Efficiency: Cash books streamline the recording of cash transactions, making the process more efficient.

2. Transparency: They provide a clear and concise record of cash movements, enabling easy tracking of cash balances.

3. Simplicity: Cash books are relatively simple to maintain, making them suitable for small businesses with straightforward cash transactions.

4. Internal Control: They contribute to internal control by providing a record of cash transactions, reducing the risk of errors or fraud.

5. Integration: The totals from the cash book are periodically posted to the general ledger, ensuring consistency in financial records.

The cash book is an essential tool for businesses to monitor and manage their cash flow, providing a real-time record of cash transactions. It is crucial for maintaining accurate financial records and facilitating effective financial management.

- Contra Entry

A contra entry refers to a specific type of accounting entry that involves both a debit and a credit entry that offset each other. In a contra entry, the same financial transaction is recorded on both the debit and credit sides of the accounting system. Contra entries are commonly used to adjust or reverse previously recorded transactions without actually affecting the overall account balances.

There are two main types of contra entries:

1. Contra Entry in Cash Book:

Nature: This type of contra entry involves both cash and bank accounts

Example: When a business withdraws cash from its bank account, it records a debit entry in the bank column of the cash book to reflect the decrease in the bank balance. Simultaneously, it records a credit entry in the cash column of the cash book to show the reduction in the cash held by the business.

2. Contra Entry in General Journal:

Nature: In this case, the contra entry is recorded in the general journal.

Example: An example of a contra entry in the general journal is when a business owner deposits personal funds into the business bank account. The business records a debit entry to increase the bank balance and a credit entry to the owner’s equity or capital account.

Characteristics of Contra Entries:

1. Same Amount: The debit and credit entries in a contra entry have the same monetary value.

2. Same Account: Both entries involve the same account, but they are recorded on opposite sides (debit and credit).

3. Offsetting Effect: The purpose of a contra entry is often to offset or neutralize the impact of a previous entry.

Purposes of Contra Entries:

1. Correction of Errors: Contra entries are used to rectify mistakes made in the original recording of transactions.

2. Adjustments: They are employed for adjustments such as reversing entries, correcting entries, or canceling out certain transactions.

3. Internal Transfers: Contra entries can be used to account for internal transfers of funds between different accounts within the same entity.

4. Bank and Cash Adjustments: They are commonly used to reconcile cash and bank balances.

It’s important to note that contra entries do not impact the overall financial position of a business; they only serve to adjust specific accounts or correct errors. These entries are typically used for internal accounting purposes and are not intended to represent actual external financial transactions.

- Petty cashbook

A petty cashbook is a subsidiary ledger or a specialized accounting book used by businesses to record small, routine, and miscellaneous cash expenditures. It is a convenient way to manage and control minor expenses without having to go through the formalities of writing a check or processing a regular cash transaction. The petty cashbook helps in keeping track of small disbursements and maintaining transparency in the utilization of petty cash funds.

Here are the key features and aspects of a petty cashbook:

1. Purpose:

Recording Small Expenses: The petty cashbook is used to record small, day-to-day expenses such as office supplies, postage, taxi fares, and other minor expenditures.

2. Funding:

Petty Cash Fund: A fixed amount of money, known as the petty cash fund, is set aside to cover small expenses. This fund is replenished periodically as it gets depleted.

3. Format:

Columns: The petty cashbook typically consists of columns for date, particulars (description of the expense), voucher number, and amount.

Categories: It may have separate columns for different categories of expenses to facilitate easy tracking.

4. Vouchers:

Supporting Documentation: Each expenditure recorded in the petty cashbook is supported by a petty cash voucher, which is a receipt or documentation for the expense.

Authorization: The vouchers are usually signed by the person responsible for approving petty cash expenditures.

5. Reconciliation:

Regular Replenishment: The petty cash fund is replenished at regular intervals. To replenish the fund, the total expenditures recorded in the petty cashbook are reimbursed, and a new fixed amount is given for future expenses.

6. Controls:

Internal Controls: The petty cashbook is subject to internal controls to ensure that the funds are used for legitimate business purposes and that there is accountability for each expenditure.

Steps in Petty Cash Management:

1. Establishment of Petty Cash Fund:

– Determine the fixed amount of money to be designated as the petty cash fund.

2. Recording Expenses:

– Record each small expense in the petty cashbook, along with supporting documentation.

3. Replenishment:

– When the petty cash fund is low, replenish it by reimbursing the total expenditures recorded in the petty cashbook.

4. Documentation:

– Keep accurate records, including vouchers and receipts, to support each petty cash expenditure.

5. Review and Control:

– Regularly review and control petty cash transactions to ensure compliance with policies and procedures.

The use of a petty cashbook helps businesses manage small cash transactions efficiently, maintain transparency, and ensure proper accounting for minor expenditures. It is a practical tool for organizations to handle small, day-to-day financial transactions without the need for complex procedures.

- Double column cash book

A double column cash book is a specialized cash book used in accounting that has two separate columns for recording cash transactions. The purpose of having two columns is to distinguish between different types of cash transactions, typically cash and bank transactions, and provide a clear and organized view of the company’s financial activities. This type of cash book is commonly used in businesses to maintain a comprehensive record of both cash and bank transactions.

The two main columns found in a double column cash book are:

1. Cash Column:

Record of Cash Transactions: This column is used to record all transactions involving physical cash. It includes receipts and payments made in cash.

2. Bank Column:

Record of Bank Transactions: The bank column is used to record transactions related to the bank. It includes deposits, withdrawals, and other bank-related activities.

Key Features of Double Column Cash Book:

1. Separation of Cash and Bank Transactions:

The main feature of a double column cash book is the clear separation of cash and bank transactions. This separation makes it easy to distinguish between the two types of transactions.

2. Comprehensive Record:

– The double column cash book provides a comprehensive and consolidated view of both cash and bank transactions. This is particularly useful for businesses that frequently deal with both cash and banking activities.

3. Easy Reconciliation:

– The structure of the double column cash book simplifies the process of bank reconciliation. The bank column facilitates the tracking of cash movements in and out of the bank account.

4. Facilitation of Accounting Entries:

– The double column cash book streamlines the recording of accounting entries for both cash and bank transactions. It serves as a primary record for the cash and bank accounts.

Typical Entries in a Double Column Cash Book:

1. Cash Receipts:

– Cash sales

– Cash received from debtors

2. Cash Payments:

– Payments for expenses in cash

– Cash purchases

3. Bank Receipts:

– Amounts deposited in the bank

– Interest received from the bank

4. Bank Payments:

– Payments made by check or electronically

– Bank charges

Example of a Double Column Cash Book:

“`

| Date | Particulars | Cash ($) | Bank ($) |

|————|——————————|———-|———-|

| 2023-01-01 | Cash sales | 500 | |

| 2023-01-05 | Paid rent in cash | (200) | |

| 2023-01-10 | Bank deposit | | 1,000 |

| 2023-01-15 | Cash purchase of supplies | 150 | |

| 2023-01-20 | Received payment by check | | 700 |

| 2023-01-25 | Bank withdrawal | | (300) |

| 2023-01-31 | Cash received from debtors | 300 | |

“`

In the example above, the cash column records transactions involving physical cash, while the bank column records transactions related to the bank account. This format provides a clear breakdown of both cash and bank activities.

The double column cash book is a practical tool for businesses to maintain a detailed record of cash and bank transactions in a structured and organized manner. It facilitates effective financial management and reporting.

- Types of double column cash book

There are primarily two types of double column cash books commonly used in accounting:

1. Single Column on Both Sides:

– This type of double column cash book has a single column for cash transactions on both the receipt (CR) and payment (CP) sides. On the CR side, it records cash receipts, and on the CP side, it records cash payments. The bank column is used for bank transactions.

“`

| Date | Particulars | Cash ($) | Bank ($) |

|————|——————————|———-|———-|

| 2023-01-01 | Cash sales | 500 | |

| 2023-01-05 | Paid rent in cash | (200) | |

| 2023-01-10 | Bank deposit | | 1,000 |

| 2023-01-15 | Cash purchase of supplies | 150 | |

| 2023-01-20 | Received payment by check | | 700 |

| 2023-01-25 | Bank withdrawal | | (300) |

| 2023-01-31 | Cash received from debtors | 300 | |

“`

2. Separate Columns for Receipts and Payments:

– In this type, there are separate columns for cash receipts (CR) and cash payments (CP) on each side. The bank column remains the same. This format provides a clear distinction between cash receipts and payments.

“`

| Date | Particulars | CR ($) | CP ($) | Bank ($) |

|————|——————————|——–|——–|———-|

| 2023-01-01 | Cash sales | 500 | | |

| 2023-01-05 | Paid rent in cash | | (200) | |

| 2023-01-10 | Bank deposit | | | 1,000 |

| 2023-01-15 | Cash purchase of supplies | 150 | | |

| 2023-01-20 | Received payment by check | | | 700 |

| 2023-01-25 | Bank withdrawal | | | (300) |

| 2023-01-31 | Cash received from debtors | 300 | | |

“`

In both types, the cash columns are used to record transactions involving physical cash, and the bank column is used for bank-related transactions. The choice between these types depends on the preferences of the business and the level of detail required in recording cash receipts and payments.

These double column cash books are useful tools for small and medium-sized businesses to maintain a clear and organized record of cash and bank transactions, facilitating effective financial management and reporting.